5 steps to start investing into p2p loans

If you are looking for concise and actionable guidance on what to consider and how to invest into p2p loans, then this chapter should be a good start. In particular, this article contains many general knowledge about investing that goes beyond p2p investing. It shall help the first-time investor to see the broader context of p2p loans for investment portfolios.

1. Learn the basics

The Investor mindset

First of all, you absolutely must acquire a minimum of general knowledge regarding «investing». In spite of the technicalities and the jargon used, investing is no rocket science. The best practices are easy to learn, but in reality not always easy to follow. Discipline, realistic expectations and serenity will make you succeed more likely than overly optimizing or taking impulsive action.

You will, however, find an abundance of advisors, gurus and literature on the subject of investing. After a while, you may find them a bit repetitive. Still, for a beginner it is good to get familiar with them. We have collected a list of recommendations, of which we hope they bear some investment wisdom. The classic investing principles for us are:

- Only make investments that you understand

- Diversify

- Never lose money

- Do not complicate your life by building complicated portfolios

- Invest for long term goals (we are talking about decades, not years)

- Raise your savings rate, rather than expenditures, when your salary increases

- Start early in your life with saving and investing

- Earn high returns through compound interest

- The poor get in debt for houses, cars, marriage parties, holidays and other status symbols (things that cost you money). The rich invest in assets (things that let your wealth grow)

- Forget get quick rich schemes and other nonsense

- No, you may not become entirely “financially free” in your life – still investing is worthwhile

Asset classes

After having acquired the right mindset of an investor, you should get an overview over the assets you can invest into. We start the following list with low risk, low returns investments, but high liquidity. The higher the risk, the higher the returns may be, but you usually should lose liquidity (get familiar with the concept of the magic triangle of investment):

- bank account savings – you will get very low returns, but should have immediate access to your money.

- capital life insurance and retirement schemes – you get low returns, but have (hopefully) some legal frameworks protecting your capital from, for example, unemployment or disability. There may be tax advantages, too.

- natural resources – gold, platinum and silver are seen as crisis currencies.

- state bonds – depending on the risk level of lending money to states, it can be low or high returns. Bonds are usually seen as more stable in times of economic crisis than stocks.

- stocks and investment funds, ETFs (Exchange Tradet Funds), REITs (Real Estate Investment Trusts) – nowadays, stocks and passive index investments (ETF) are becoming the backbone of many portfolios.

- real estate – real estate prices have skyrocketed. It can be a very rewarding investment. However, transaction costs are rather high and liquidity is very low. Liquidity may improve a bit if you rent your real estate to someone instead of selling it.

- crypto currencies – are a new asset class. For technological reasons, bitcoin is seen as a form of digital gold. Other cryptocurrencies have a different focus in terms of asset qualities. Being a relatively young asset, the risks are partly unforeseeable.

- p2p lending and investing – still a rather niche form of investing, p2p lending is highly profitable but also riskier than other forms of investing.

- start ups – starting your own business (or investing in the business of others) can be highly profitable, but is also very hard. It is said that around 90% of the start ups fail.

When we will later talk about building your portfolio, you will see that usually you would pick the appropriate mix of asset types.

2. Assess your financial situation

Income-expenses budget sheet

Every investor must be informed about the own financial situation. So your next job is very fundamental. If you like a simple, but analytical approach to track your finance, you can try this out.

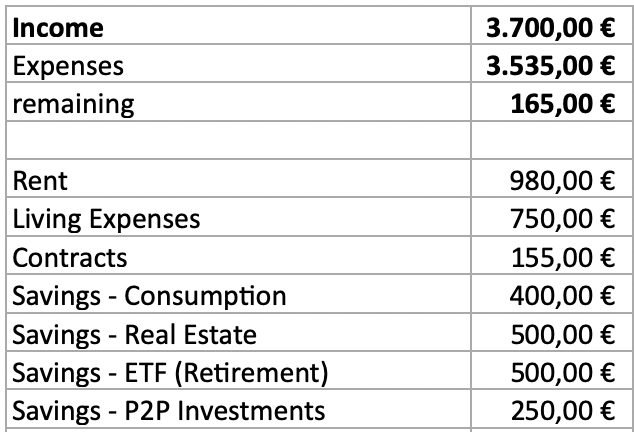

First, we recommend you to create a very simple, yet powerful excel sheet. We call it the income-expenses budget sheet (download for free). It looks somewhat like this:

As you can see, you do nothing else but tracking your monthly income, your accumulated expenses, and then calculate the remaining balance of it.

Most private households have but one source of income: their wages. Others may add rent payments, capital or other source of income. Hopefully, we soon can add income from p2p loans here 🙂

Regarding the expenses, of course we all have all kinds of expenses. Personally, we stick to a coarse grained list. Of course you can adapt the granularity according to your needs.

The point of this budget is really to control two things: your money flow (especially the outflow) and your savings rate.

Money flow

Regarding the money flow, you should usually administrate your recurring transfers around the date of your main income. So let’s say your income is paid every 15th of a month. Then, with a margin of two to three days, you should program your transfers for expenditures and for savings.

So lets say, for the 17th you should transfer the total amount of money you want to save and invest to a separate savings account. You can use also more than one extra account, but for the sake of simplicity, let’s assume here, that you use one current account and one savings account. Now, you are good to go to channel the saved money in your particular investment classes.

Savings rate

But where and to what extent you want to channel your money? This is where your savings rate comes into play. The savings rate is very simple maths:

Just take your monthly savings and divide them by your monthly income. So in our example here, we add up all savings (400+500+500+250=1650 € being saved every month) and divide them by the household income (that is 3700€ a month). The result is approximately 1650/3700=0.45. That reads 45%. So this savings rate would be super high!

For the beginning, we recommend you a minimum savings rate of 10% of monthly net income. You can then start to increase your savings and investment rate gradually. For our rather wealthy person here, it would result in a savings target of “only” 3700*0.1=370€ a month. That seems to be a bit low for such a high income.

You should now establish how much money you want to spend for each budget item. We would like to give you some rough orientation:

- Housing costs – the fundamental rule is that your housing costs should not exceed 30% of your net income. So in our example you should target a flat or house rate for not more than 3700*0.3=1110€. Needless to say that in urban cities this is almost illusory to achieve. Our person here pays 980€ a month. Very good!

- Fundamental living costs – we usually recommend to have a comfortable target of expenses for all kinds of regular expenses, such as groceries, clothing, leisure, restaurants and so on. Depending on your lifestyle, you can plan something like 750€ a month.

- Contracts – this includes electricity, water, heating, internet connection, mobile phone, insurances – but also fitness studios and other contracts. You can try to slash costs here.

note: If you have a family and children, your expenses most likely will increase. You can just adapt the numbers or add categories according to your needs.

note also: The numbers presented here represent a high income, low cost case for a Western European country. You have to adapt this numbers to your personal and national economy. However, they should give you some feeling for the proportions.

This is just one example of how to do your income-expenses budget sheet. By time, you will definitely update. However your financial situation changes, this little tool should from now on always accompany you.

3. Build your portfolio

Now we can have a look on a particular “expense” category – the savings. Savings are not really expenses because, being invested, they are getting transformed into capital. Provided that they gain in value over time, of course.

But be aware. So far we have talked little about risks of investing. Every investment is risky. Please get familiar with the risks and the realities of losing money before starting investment adventures. Having said that, where there is risk, there are chances. In our opinion, it is absolutely justified to take the risk of investments given the historically proven rewards.

Still, always have a strategical liquidity reserve of 3-6 monthly net income in a savings account. This is for emergencies only (that is sickness, job loss, or others). Don’t think it is important? Well, believe it, but when the Corona crisis broke out in February 2020 and crashing the economy, many, many people should have had that iron safety net. But they hadn’t, and instead spent all their money for holidays, cars and you name it.

And here the fun part starts. You are going to start building your portfolio and see your money grow. We have listed here typical monthly saving and investment targets for a private person:

Consumption savings

This rather odd category shall include all short to midterm savings. You want to go on holiday? You want to buy a fancy car? You want to buy electric appliances for your flat? Than you need a budget for it! Think of it as a budget for wealthy lifestyle and rather things that you want to allow yourself to have a good life.

Insurances

Although also not really part of your portfolio, you should consider to sign the most existential insurance contracts. According to German DIN norm 77230, the most fundamental insurances build protection around your labor income. The following advice is of course subject to your personal opinion about insurances. Still we see them as highly recommended if you want to increase your level of economic protection.

You should get a personal liability insurance to be protected against claims that you incur from damages to others.

You should also definitely insure your body and soul against disability. In case you suffer from a terrible strike, you should have some remedy against the financial loss.

Finally, if you are married and have children, you should have a risk life insurance. In case you die, your family can survive for some years while digesting the emotional shock. Please contact competent insurance advisors to help you.

Retirement savings with stocks and state bonds

With welfare states crumpling apart, you should really start early to save and invest for your retirement. It is good to get informed how much money you actually need when you are old. There you will find out that a considerable amount of your monthly income should be for long term living expenditures only. And that is mainly when you retire.

We personally would recommend a simple ETF portfolio. Nothing fancy, nothing complicated. Just get two savings plans, one MSCI World All Country (ACWI) Index. With this fund you will get covered more than 2000 shares of the strongest companies of the world economy. To a lower extend (maybe 10-20% of your ETF investments) you could invest in state bonds.

Real estate

If one day you want to buy your own private property, you need to have the right amount of funds. Especially if you want to ask for a mortgage, you should have at least some 25% of starting capital regarding the borrowed sum. Furthermore, you should have a separate account for this rather midterm to longterm savings goal. It is said that for most places, it will be cheaper in the long run to possess your own property than renting it. There are exceptions to that rule, especially in urban hot spots. There it is almost impossible for a normal person to buy houses anymore. So consider to start saving money for real estate, even though you are still paying a rent.

Peer-to-peer investments

To give the portfolio an extra boost, the person here invests every month 250€ into peer-to-peer loans. By time, this can generate passive income from the interest paid to the loans. For us, peer-to-peer loans are a very profitable, but also considerably risky investment. However, if you have built a solid financial fundament by complying with our recommendations above, there is no problem with building extra wealth.

After having laid out the fundaments of their portfolio, investors can consider to invest 5-15% of their savings into peer-to-peer loans. Without doubt, peer-to-peer lending can give your portfolio a very profitable stream of passive income.

Peer-to-peer credits are a fascinating and interesting field of money lending. With great returns beyond 10% per year, you should be able to make a decent extra income. From now on, we will focus on peer-to-peer investments.

4. Pick a platform

Although still under constructing, the whole purpose of beyondp2p.com is to help first-time investors to pick the right platforms that fit their profile best.

You should first get an overview in which loan types you can invest per platform:

- Consumers – that is the core of peer-to-peer investing. Other people need money, you give it to them in form of a loan. They pay you back interest.

- Companies – you invest into businesses, but also often just into their founders.

- Real estate – you invest into rather corporate real estate projects.

- Leasing – Owners lease property, buildings and vehicles to lessees for the usage of an asset.

How to find platforms?

With the top platforms table, you can have a first overview of the biggest p2p platforms in the market. We recommend you to pick the one that catches your interest first, and then just exploring it freely.

On the bottom of the platform page, you find a button to compare one platform with a maximum of two others. We are working hard to improve the data provided and give you the best overview possible.

As a general rule, we would stick to one of the bigger platforms in the market. They have a lot of experience and customers in this field and usually offer a great set of features.

5. Start investing

When you finally found your favorite platform, you should take it easy. Start slow and invest every month a moderate rate. If you have made some months of experience, start increasing your rate or invest bigger chunks.

For all what has been said. If you are a first-time investor, please take the following recommendations serious:

Starting slowly with investments and not overly optimizing your portfolio – both rules are key for a successful long-term strategy.

As a beginner, you likely will make some “mistakes”. You got to be patient! They are there for you to learn from them. But it is also our hope, that with the help of this guide that you not only can minimize mistakes. Within a matter of months, you should be able to drastically improve your financial situation. Isn’t the outlook worth the waiting?

Further reading

- 5 Best Practices to Start Investing

- Looking for a Good Investment Return? Use the Magic Triangle!

- DIN e.V. (2019): Basic financial analysis for private households. The core of recommendations in this article have been defined as German Industry Norm (DIN) number 77230.