P2P Sniper

Maximize Your P2P Earnings with Instant Loan Alerts

Are you investing in peer-to-peer loans and tired of settling for lower returns?

P2P Sniper monitors major peer-to-peer lending platforms and instantly notifies you when a top-paying loan becomes available.

Never miss out on 14.50% interest loans again – while others settle for the leftovers.

Sign up in Seconds – It's Completely Free!

Just tell us your minimum interest rate, and we'll send you real-time alerts on Telegram as soon as a loan that matches your criteria becomes available – no matter which platform it’s on.

Start Receiving Alerts Now

Minimum Interest Rate:

Filter for loans with at least 14.00% interest.

Why P2P Sniper?

P2P Sniper gives you a competitive edge. While auto-invest features can be slow to react, our nearly instant Telegram alerts let you beat the system and grab the best-paying loans before they’re gone. For platforms that don’t support manual investment, you’ll still stay informed about the best available interest rates, so you know where to focus your funds.

How it Works

- Set your minimum interest rate: Choose your desired minimum rate (e.g., 12% or more).

- Receive nearly instant alerts: Get notified in real time – faster than auto-invest!

- Secure the best returns: Act fast and secure loans with the highest returns available.

No hidden fees, no spam – just actionable alerts when you need them.

Live Loan Opportunities

The last update happened just 5 seconds ago.

While our bot sends out alerts on Telegram, we’re also keeping the table below updated: Here’s the latest snapshot of active loans that P2P Sniper detected just within the last seconds. These high-interest opportunities are moving fast, but if you act quickly, you can still secure some of them before they’re gone (or, you know, sign up for the bot so you get notified immediately when new loans become available).

Platform (Click to sort ascending) | Market (Click to sort ascending) | Loan Originator (Click to sort ascending) | Loan Type (Click to sort ascending) | Country (Click to sort ascending) | Loan Count (Click to sort ascending) | Interest Rate (Click to sort ascending) |

|---|---|---|---|---|---|---|

Primary | Latvian Forest Development Fund | Business | Latvia |

1

| 14.50% | |

Primary | Latvian Forest Development Fund | Business | Latvia |

2

| 13.50% | |

Primary | Sandfield Capital | Litigation loan | United Kingdom |

533

| 13.50% | |

Primary | Latvian Forest Development Fund | Business | Latvia |

2

| 13.00% | |

Primary | Danarupiah | Instalment loan, Bi-weekly | Indonesia |

10008

| 13.00% |

Ranking

- Capitalia at 18.24%

- Income Marketplace at 15.00%

- Debitum Investments at 14.50%

- InSoil at 14.00%

- Swaper at 14.00%

- Stikcredit at 12.00%

- Twino at 12.00%

- Esketit at 11.00%

Top 5 Platforms

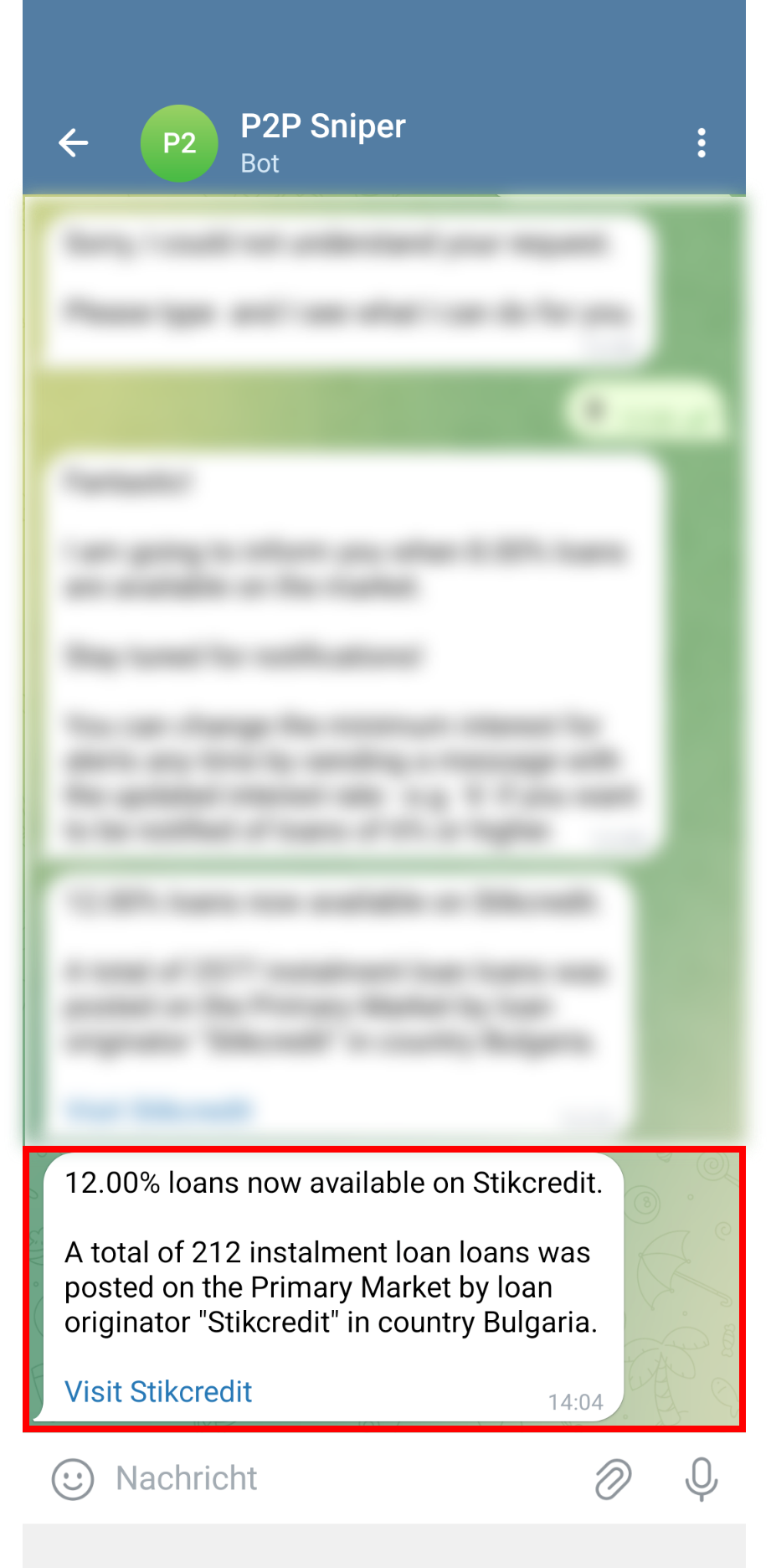

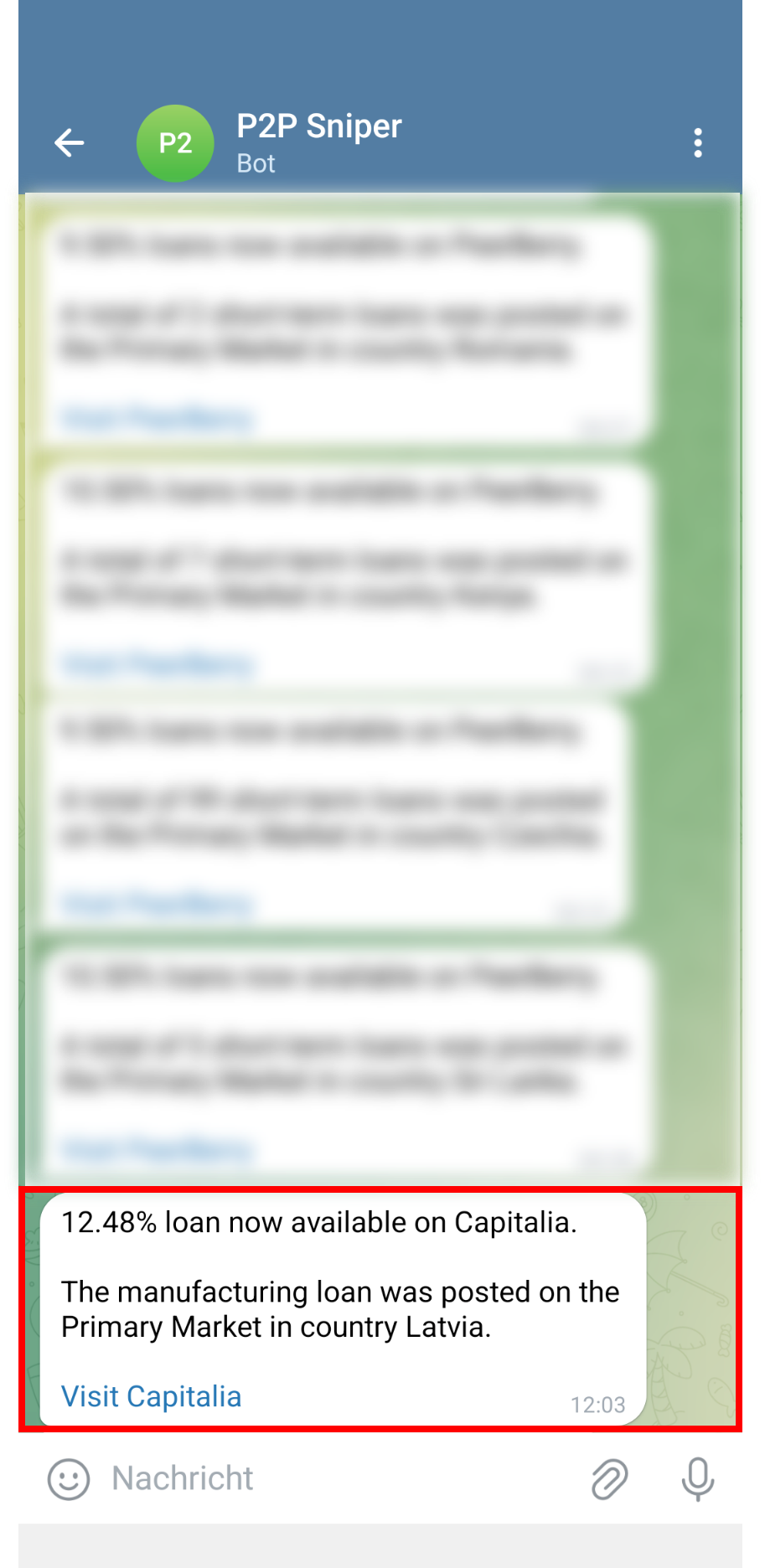

See It in Action

Curious how alerts look? Here's a sample from recent high-interest loans:

FAQs

What’s the highest interest rate I can get?

Within the last 7 days, P2P Sniper found a loan offering 14.50% interest.

Why not just use auto-invest features?

Auto-invest settings on platforms are often slow to react, meaning prime loans sit unclaimed for minutes. P2P Sniper’s instant alerts give you the speed advantage, so you can outperform auto-invest systems and secure higher returns. For platforms that don’t support manual investing, our alerts help you keep tabs on high-interest opportunities, giving you full visibility to adjust your strategies.

Can I get E-Mail alerts instead of Telegram?

E-Mail alerts are in beta! You can be notified here once those features become available.

Which platforms does P2P Sniper monitor?

We currently monitor:

- Capitalia

- Debitum Investments

- Esketit

- EstateGuru

- InSoil

- Income Marketplace

- Moncera

- PeerBerry

- Stikcredit

- Swaper

- Twino

The above links are affiliate links – use them to take advantage of any available promotions, for faster setup and to support our service at no cost to you.

Can I change alerts?

Yes, it’s as easy as replying to the bot with a single number that’ll be your new lower limit for loan alerts: Message ’12’ to the bot and you’ll only get alerts for loans that offer more than 12% interest.

Can I cancel alerts?

Yes, you can easily unsubscribe anytime by sending the

/stop command to the Telegram bot.

Is there anything else I can do to get better returns?

We recommend signing up for all supported platforms and completing KYC. This way, you’ll be ready to invest the moment an alert comes through. Use our affiliate links for faster setup and to support our service at no cost to you.

How often do I get alerts?

Loan opportunities pop up at random times, but you’ll get alerts whenever they become available at your chosen interest rate. The easiest way to receive few alerts is to set your interest as higher.

Can I filter alerts by platform or country?

This feature is in development. Join our Telegram group to stay updated on future releases!

Will you be adding additional platforms any time soon?

Yes! We’re actively working on on-boarding more platforms. You can stay informed about new features and platforms and send us your own feedback by joining our Telegram group.

Can you add platform XYZ?

Yes, of c… Actually, make that a ‘maybe’. Join the Telegram group or write us an E-Mail to ask us. We’ll happily look into it.

Ready to Secure Higher Returns?

If you have any questions, write us an E-Mail at info@beyondp2p.com or in our telegram group @beyondp2p_discussion.

Otherwise: